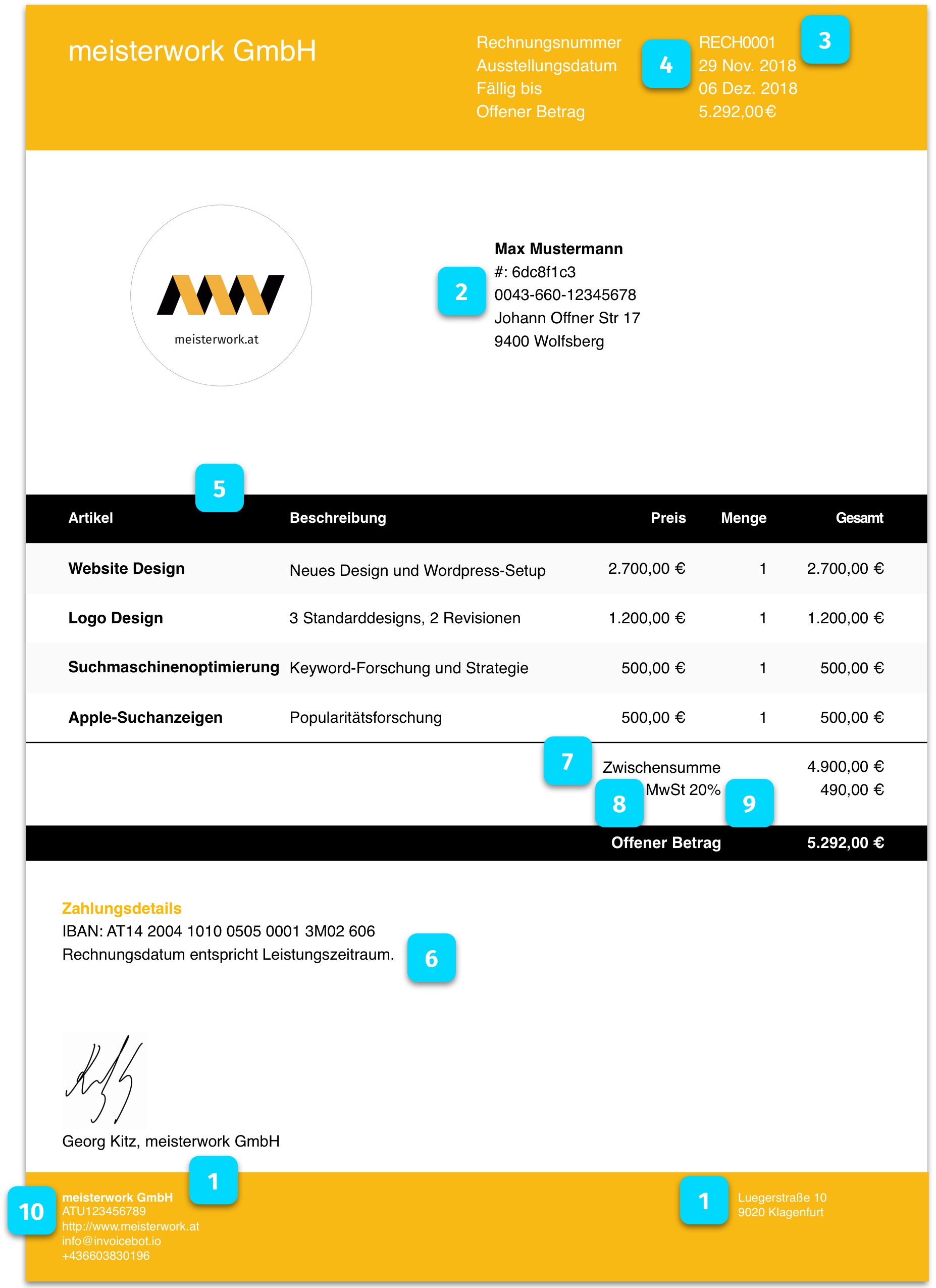

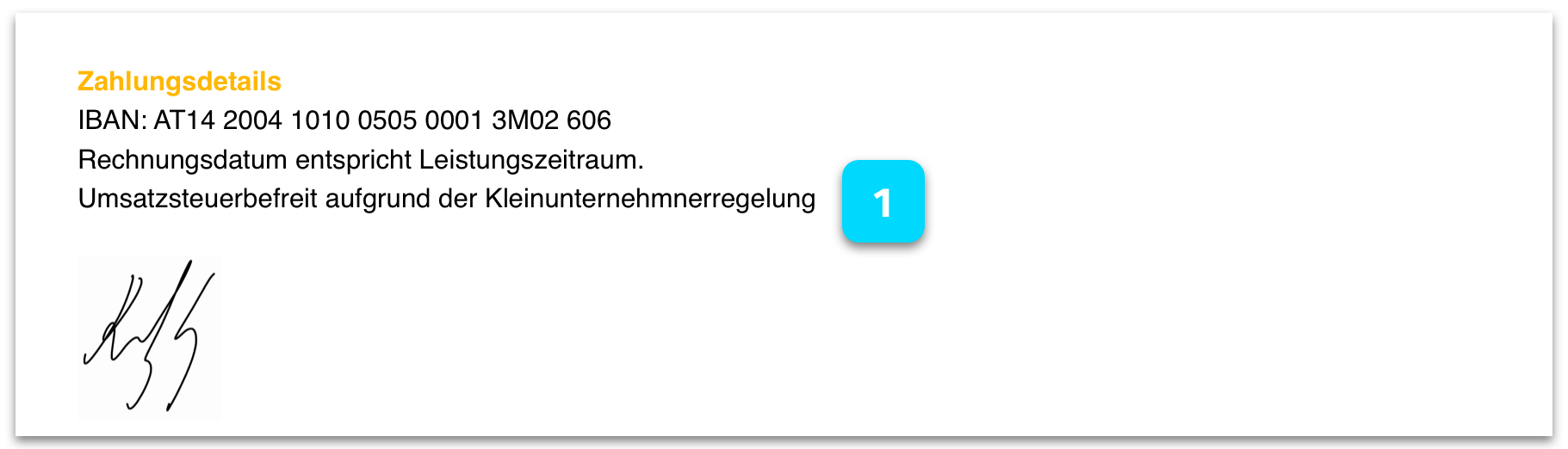

You have to follow certain guidelines in order to provide valid invoices to your customers. If you don't follow them the tax authorities are not obliged to accept them as proper invoices and this could harm you and your business.

Generally we can distinguish between 2 types of invoices: