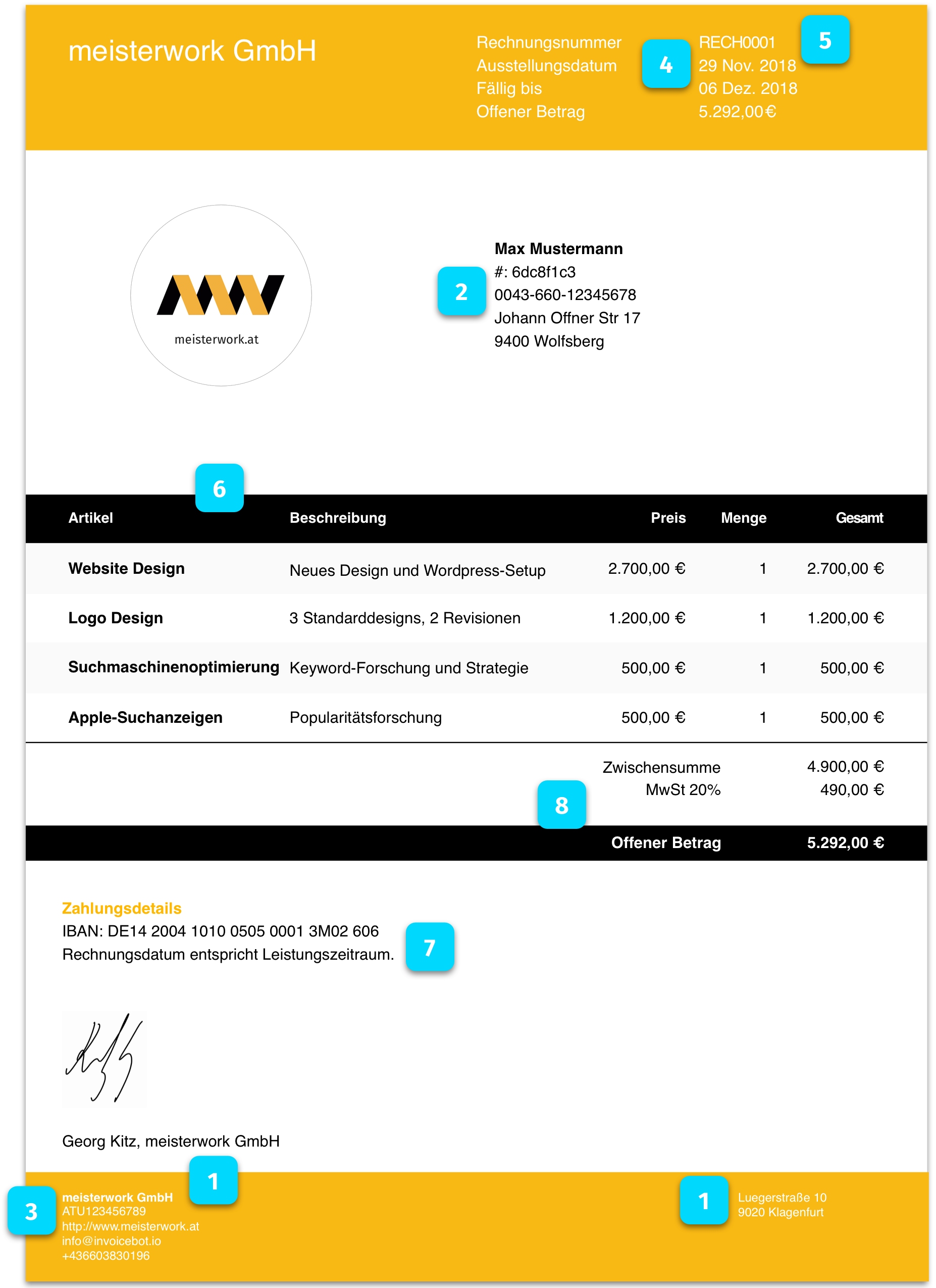

When creating invoices as a freelancer or small business owner you have to follow a specific set of rules, this is necessary to get your invoices accepted by the tax authorities.

There are 8 mandatory details you need to have on your invoice to claim pre-tax and make it a valid invoice.

There are additional informations you might want to add. It can be useful to add the word "Invoice" on your invoice to mitigate possible discussions later on when your customer thinks it was an offer or a delivery note. Further it's useful to have you contact details like email address or phone number on it in case your customer has further questions.

To get paid quicker we advice to put a due date on the invoice. According to the BGB your customer have to pay within 30 days otherwise you can send them a reminder. Further don't forget to put your bank details on the invoice plus let your customer know if there are any other options on how to pay you as an example via PayPal.

In case you don't want to worry too much about all the details, don't hesitate to download InvoiceBot from the AppStore. We take care about all the technicalities and you can focus on your work instead